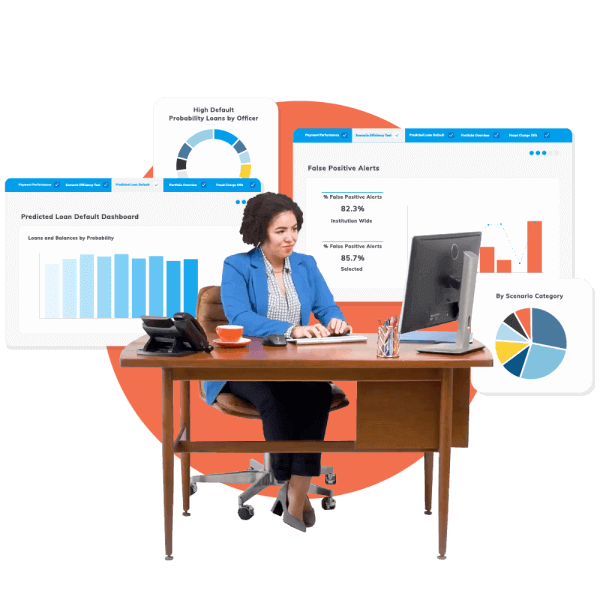

Everything you need for better banking

Abrigo's Fraud Detection helps you fight fraud faster and smarter with AI.

Banking software and consulting trusted by over 2,400 financial institutions.

Banking software for customer success

Risk management, compliance, and lending solutions that help financial institutions thrive.

If you’re a growing bank, then you have to be adaptive. Abrigo allowed us to do that.

Rich Hoban

Director of Corporate Development

Frandsen Bank & Trust

The support we get from Abrigo is a huge factor. Abrigo is more like a partner to us than a vendor or banking software provider.

Daniel Fowler

Credit Administrator

Capital City Bank

Abrigo is the only banking software company that gives us a voice for enhancements and roadmaps. They truly provide an experience and product that is unlike any other.

Kristy Esquibel

SVP

First Southwest Bank

Empower your institution

Banking software and services to

manage risk and drive growth.

Leading lending solutions and risk management software for banks

Driving automation and analytics

Imagine having one provider for everything you need to become a better bank or credit union. Accelerate growth, reduce risk, increase efficiency, and improve the customer or member experience with Abrigo solutions.Featured products:

Our Advisory Services team includes former C-suite, credit and risk executives, accountants, bank examiners, and BSA officers.

We know how to help solve problems at your bank or credit union because we've been in your shoes. Whether it's helping with portfolio risk and CECL, AML/CFT and fraud, or asset/liability management and deposit pricing, our consultants will keep your institution on the path of growth and increased profitability.